Certification & Qualification Programme

Prepare for a career in the financial services industry

Prepare for a career in the financial services industry

We offer the following certification and qualification programmes. These are accredited by local regulators and recognised by international professional bodies within the financial services industry.

This training series is dedicated to those who plan to enter into the asset management field. This training is designed to help people who do not have any knowledge and experience regarding asset management. Upon successful completion of all FOUR modules, you will be awarded the Certificate of Completion for this programme.

You can choose to enrol in the particular module(s) that you are interested in. Participants are required to attend and complete all classes specified by each module. Attendance record will be issued based on your actual attendance record.

Programme Details

Paper 1 and 2 eLearning are now open for enrolment. Please refer to the links below for details.

| Paper & Topic | Training hours |

| Paper 1 - Financial Instruments | |

| T1 - Basic Products: Fixed Income Instruments, Equity Securities and Foreign Exchange | 2.5 |

| T2 - Derivatives and Structured Products | 2.5 |

| T3 - Investment Funds and Alternative Investments | 2 |

| T4 - Portfolio Management: Theories and Practices | 1.5 |

| T5 - Lending and Leverage | 1.5 |

| Total | 10 |

| Paper 2 - Wealth Management | |

| T6 - Wealth Planning | 2 |

| T7 - Behavioural Finance | 1.5 |

| T8 - Customer Relationship Management | 2 |

| T9 - Overview of Private Wealth Management Industry | 1.5 |

| T10 - Overview of PWM Markets: Hong Kong, Mainland China and Asia-Pacific * | 2 |

| Total | 9 |

* Provided by PWMA as the unique study support of this topic.

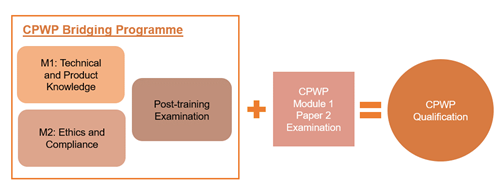

Certified Private Wealth Professional (CPWP) Bridging Programme is jointly organised by the Hong Kong Securities and Investment Institute (HKSI Institute) and Hong Kong Institute of Bankers (HKIB) that aims to nurture and expand the talent pool for private wealth management industry and to provide career advancement opportunities for retail wealth management professional through accelerating the learning process for retail wealth management professionals to pursue the CPWP Certification.

The programme that bridges the curriculum gap between the Module 1 Paper 1 and Module 2 of the Enhanced Competency Framework on Private Wealth Management (ECF-PWM) and the Enhanced Competency Framework on Retail Wealth Management (ECF-RWM) provides a trimmed version for the holders of the Certified Retail Wealth Professional (CRWP) Certification awarded by the HKIB to equip them with technical and product knowledge as well as ethics and compliance aspect in the context of private wealth management.

Watch the recording of the Briefing Session (Cantonese only) to know more about the CPWP Bridging Programme.

Individuals who meet the following requirements are eligible to enrol on the CPWP Bridging Programme:

- Valid Certification holder of Certified Retail Wealth Professional (CRWP) awarded by HKIB; or

- Completed the training and examination, or via exemption of Enhanced Competency Framework on Retail Wealth Management (ECF-RWM) Module 1 to Module 7.

The HKSI Institute will arrange withdrawal for individuals who enrolled in the programme but DO NOT fulfil any of the above prerequisites and charge a withdrawal administration fee of HK$500.

The CPWP Bridging Programme is a cohort-based programme consisting of two mandatory training modules and a post-training examination. Two cohorts would be held per year.

- Language: English

- Programme Fee: HKD 5,780

Upcoming programme schedule

|

Cohort |

Enrolment Deadline |

Date of Module 2 Training |

Examination Date |

|

10 March 2023 |

24 March 2023 31 March 2023 |

19 May 2023 |

Click the link under Cohort to enrol.

The CPWP Bridging Programme participants are required to complete all two training modules before sitting the post-training examination.

|

Module |

Topic / Chapter |

Duration* |

Delivery Mode |

|

Module 1: Technical and Product Knowledge (Operated by HKSI Institute)

|

Topic 1: Basic Products |

7 hours |

Self-paced: · eCourses

|

|

Topic 2: Derivatives and Structured Products |

|||

|

Topic 3: Investment Funds and Alternative Investments |

|||

|

Topic 4: Portfolio Management |

|||

|

Topic 5: Lending and Leverage |

|||

|

Module 2: Ethics and Compliance (Operated by HKIB)

|

Chapter 1: Banking Regulations in Hong Kong |

6 hours |

Live in-person training: · FLEX Learning |

|

Chapter 2: Investment Products and Selling Activities related Regulations in Hong Kong |

|||

|

Chapter 3: Laws & Regulations Relating to Client Engagement and What Happens When Things Go Wrong |

|||

|

Chapter 4: Code of Ethics And Conduct; Fiduciary Duties, Ethical Values And Professional Conduct |

* 7 hours of continuous professional training (CPT) and PWMA's on-going professional training (OPT) will be awarded by HKSI Institute upon the completion of Module 1, while 6 CPT hours and HKIB’s continuous professional development (CPD) hours will be awarded by HKIB upon the completion of Module 2.

For the examination purpose, the CPWP Bridging Programme participants should complete the Module 1 eCourses 5 working days before the post-training examination date and attend the Module 2 training sessions at the scheduled time.

Please note that Module 2 is a live in-person training. No remedial and rescheduling arrangement for absence from the Module 2 training sessions. All fees paid are non-transferrable and non-refundable.

Please refer to the Frequently-asked Questions (FAQs) to know more.

A certificate of completion for the CPWP Bridging Programme will be jointly awarded by the HKSI Institute and HKIB to the individuals who completed the two training modules and passed the post-training examination. The certificate holder is equivalent to passing the examinations of CPWP Module 1 (Paper 1) and Module 2 Examinations.

CRWP-CPWP Bridging Pathway

Individuals who have completed the CPWP Bridging Programme will also need to fulfil the following requirements before they are awarded the CPWP Certification by the PWMA:

- Complete the CPWP Module 1 Paper 2 Examination conducted by the HKSI Institute;

- Valid Certification holder of the CRWP Certification; and

- Currently employed by a PWMA member institution with at least 3 years of work experience performing the prescribed functions and roles of a Relevant Practitioner within a private wealth management institution in the most recent 5 years (Individuals who are not employed by a PWMA member institution and/or have not met the experience requirement are eligible to apply for CPWPA certification).

The certificate of completion for the CPWP Bridging Programme is valid for 5 years (counting from the issuing date of the certificate) for the purpose of applying for CPWP certification. For details on the requirement for CPWP Certification, please refer to the PWMA website.

IMPORTANT NOTICE:

TTC (version 2.0) has now been launched. Please refer to the separate page for details.

For the old syllabus, the last offering is scheduled as follows.

|

Part A |

Part B |

||

|

Training |

Examination |

Training |

Examination |

|

NO offering |

Saturday, 1 June 2024 (9:15 – 10:45am) |

In eCourse format (*), from 6 March 2024.

|

For both Streams 1 & 2: Saturday, 8 June 2024 (9:15 – 10:45am) |

(*) TTC conducted in eCourse format is NOT eligible for the Financial Incentive Schemes of the WAM Pilot Programme (link).

Please see below for the details about the programme, fees, etc.

TTC is a core component of achieving the Hong Kong Trustees' Association ("HKTA") Certified Trust Practitioner™ (CTP) designation. The training course is structured in 2 parts (Part A and Part B). The entire course consists of 14 units and 42 hours. Participants are required to complete the full course.

Collectively all mandatory units completed from Part A and either Stream 1 or 2 of Part B form the full course (14 units in total). Participants who successfully attend and complete the full course and pass the examination for both parts will be awarded "Trust Training Certificate".

| Part A | Part B | |

| Training | 7 compulsory units |

7 compulsory units under either Stream 1 or 2 Two streams:

|

| Examination | To be held about 4 weeks after the training courses | To be held about 4 weeks after the training courses |

For details, please refer to the HKTA website.

Please note that no training session or revision session will be provided for this cohort of Trust Training Certificate ("TTC") Part A.

- Since there are no training sessions available, participants who wish to take the Paper-based TTC Part A Examination on Saturday, 1 June 2024 (09:15am - 10:45am) should directly enrol for the Part A examination.

- Participants need to refer to the study materials from the April 2021 version for preparation.

TTC is a core component of achieving the Hong Kong Trustees' Association ("HKTA") Certified Trust Practitioner™ (CTP) designation, which was introduced in 2018.

In 2024, the programme has undergone a revamp and is now known as TTC (version 2.0).

The training programme is structured in 2 parts (Part A and Part B). The entire programme consists of 14 units and 42 training hours. Participants are required to attend the full programme in order to fulfil the requirement for the CTP designation.

Collectively all mandatory units completed from Part A and either Stream 1 or 2 of Part B form the full programme (14 units in total). Participants who successfully attend and complete the full programme and pass the examination for both parts will be awarded "Trust Training Certificate".

|

|

Part A |

Part B |

|

Training |

7 compulsory units |

7 compulsory units under either Stream 1 or 2 Two streams:

|

|

Examination |

To be held about 4 weeks after the training courses |

To be held about 4 weeks after the training courses |

For details, please refer to the HKTA website.

Below is the overview of the Trust Training Certificate ("TTC") Part A (version 2.0). The training session will be run in webinar format.

- To be eligible to sit for the TTC (version 2.0) Part A Examination, participants must enrol in and attend all seven (7) units.

- Upon completion of the training sessions, participants are required to take Part A Examination.

- The total training and exam package cost for the all-inclusive units, which covers all seven (7) units and the Part A Examination is HKD15,000. This price includes the examination fee of HKD2,200 and reflects a discount from the original price of HKD16,700.

- Candidates need to attend the Examination in person at the HKSI Institute.

- All examination candidates will be invited to join an optional 3-hour Revision Session in webinar format.

- If participants wish to apply for Experienced Practitioner Exemption ("EPE"), please contact HKTA to confirm their eligibility before enrolling in Unit 6.

- Corporate group enrolments can further enjoy discounts off the training package price when undertaking all seven (7) units of Part A:

|

3-5 staff |

5% off |

|

>5 staff |

10% off |

*Please call 3120 6100 or email [email protected] for group discount offers.

- Participants seeking a comprehensive understanding of the subject matters have the flexibility to choose and attend any unit(s) they are interested in.

Please refer to the table below for the unit names and course details.

TTC Part A enrolment started on Friday, 8 March 2024. For those who wish to register, please be informed that the enrolment deadline is Monday, 8 April 2024 (11:59pm). Please also note that:

- To register for the training and exam package (Unit 1 to 7 webinar training sessions, Revision Session, and the Examination), click on the link provided in the first row “TTC Part A Training and Examination Package”

- Apart from enrolling in the training and exam package, learners have the option to enrol in one or more selected units. To do so, click on the unit name and choose 'Apply Online' and 'Select more.' The system will consolidate the units chosen, and payment will be made based on the total course fee.

|

Stream/Unit |

Stream / Unit name |

Module/Remarks |

Date |

|

1-7, Revision Session & Examination |

For the details of each unit, please refer to its respective course page. |

Please refer to the dates listed below |

|

|

1-7 |

TTC Part A Training Package |

For the details of each unit, please refer to its respective course page. For enrolment, please contact us at [email protected]. |

Please refer to the dates listed below |

|

1 |

M1: Overview of Trusts M2: Fundamental Principles and Structure of Trusts |

9 April 2024 (Tuesday) 18:00 - 21:00 |

|

|

2 |

M3: Types of Trust and their uses M4: Retention of Control |

16 April 2024 (Tuesday) 18:00 - 21:00 |

|

|

3 |

M5: Other Estate Planning/Succession Vehicles M6: Trust Protection Issues |

23 April 2024 (Tuesday)

18:00 - 21:00 |

|

|

4 |

M7: Trusts Compared with Other Estate Planning Vehicles |

30 April 2024 (Tuesday) 18:00 - 21:00 |

|

|

5 |

M8: Trustee Duties M9: Hong Kong Securities and Futures Commission Regulatory Activity 13 Regime M10: Hong Kong Monetary Authority’s Code of Practice for Trust Business |

27 May 2024 (Monday) 18:00 - 21:00 |

|

|

6 |

M11: Compliance, AML, Legislative rules and how they apply to Trusts Part A - AML Ordinance and Companies Registry Requirements for Trust or Company Service Providers M12: Compliance, AML, Legislative rules and how they apply to Trusts Part B - Automatic Exchange of Information ("AEOI") FATCA and CRS Reporting Requirements for Trustees |

13 May 2024 (Monday) 18:00 - 21:00 |

|

|

7 |

M13: International Comparison of Trusts |

21 May 2024 (Tuesday) 18:00 - 21:00 |

|

|

Revision session |

Optional for candidates who have registered into the examination. |

4 June 2024 (Tuesday) 18:30 - 21:30 |

|

|

Part A Examination |

Computer-based examination. |

15 June 2024 (Saturday) 09:15 - 10:45 |